The CARES Act, a $2 trillion economic stimulus package, was signed into law in March. A provision of the law will provide financial relief to most Americans as a result of the COVID-19 pandemic. Below you will find answers to common questions regarding these economic impact payments.

1. How large of a payment will I receive?

The CARES Act outlines the parameters of who is eligible to receive a payment. The Internal Revenue Service (IRS) is the agency responsible for determining eligibility. Single adults with an adjusted gross income of $75,000 or less will receive $1,200. Married couples earning a combined adjusted gross income of $150,000 or less will receive a total of $2,400. Individual and married taxpayers earning over $75,000 and $150,000 respectively will get reduced payments. Payments will phase out for individuals earning over $99,000 or married couples making over $198,000. There are additional $500 payments for dependent children.

For complete eligibility information, please visit the IRS website.

2. Will college students be eligible to receive a payment?

College students not claimed as a dependent on another taxpayer's return are eligible for an economic impact payment.

For complete eligibility information, please visit the IRS website.

3. When will I receive my payment?

The Department of the Treasury started sending payments on April 10, 2020. If you filed taxes in 2018 or 2019 and included your bank routing and account number for payments or refunds, and this information has not changed, the IRS has the information it needs to send your payment electronically.

For Social Security recipients, the IRS will use direct deposit by the Social Security Administration to facilitate payments. If the direct deposit information you have provided in the past is for a bank-issued prepaid debit card, you will receive your funds on that card account.

If the IRS does not have your information on file, you will be mailed a check. Check payments will follow weeks or possibly months after the direct deposits are sent.

4. Can I receive my payment electronically if my current information is not on file with the IRS?

The IRS developed an online portal called Get My Payment so you can check the status of your information and your payment. In addition, the IRS has launched a new web tool allowing quick registration for those who don't normally file a tax return. For the most up-to-date information, visit IRS.gov/coronavirus.

While the IRS has extended the tax filing deadline this year from April 15 to July 15, another option is to file your 2019 taxes as soon as possible with your bank routing and account number provided on the form.

5. What if I am typically not required to file a tax return?

People who typically do not file a tax return and are not Social Security beneficiaries will need to file a simple tax return to receive an economic impact payment. Certain low-income taxpayers, veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. The IRS will soon provide information instructing people in these groups on how to file a 2019 tax return with simple but necessary information, including their filing status, number of dependents and direct deposit bank account information. As noted above, Social Security recipients who have not been required to file tax returns will not be required to file a tax return to receive their payments.

6. What is a bank routing and account number?

Bank routing and account numbers direct payments to the right bank account at the right financial institution. If you have a checking account at INTRUST, the information is located on the bottom left hand corner of your paper checks or can be found on any statement. INTRUST Bank’s routing number is 101100029.

7. How do I find this information if I don't have a check?

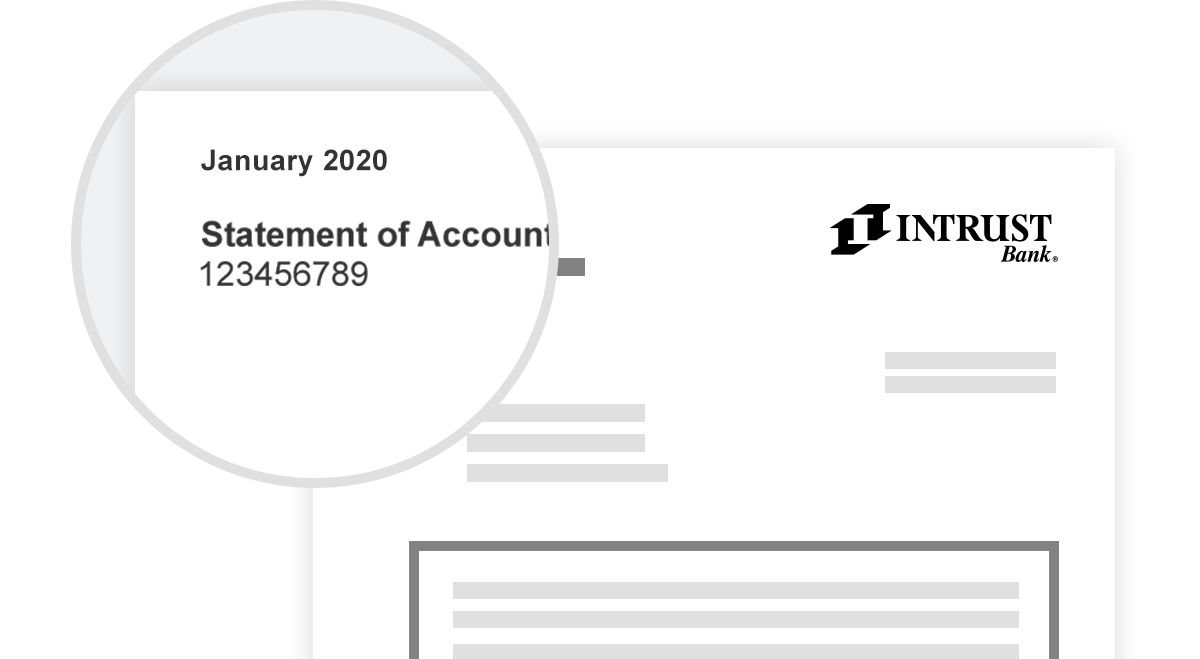

You can easily find your account number through online banking. Login and select Documents from the main menu to view your most recent statement. Your account number is located on the first page of the statement in the top left-hand corner.

You can also contact us for more information.

8. I have a bank account. Can I still receive a paper check?

Yes, but be aware that your payment will be slower than an electronic transfer. Paper checks may be sent out months after the electronic checks are sent.

If you are opting to wait for a paper check, you can easily deposit the check into your account using INTRUST Mobile Banking or visit one of our drive-thru locations.

9. What can I do to prevent fraudsters from accessing my funds?

There will be an increased number of scammers looking to take advantage of funds disbursed through the CARES Act. It is important to never provide your bank account, debit or credit card number to anyone. Also, never share your passwords, online banking login credentials and know that INTRUST, or any legitimate company, will never request your password. Learn more about how to protect yourself from COVID-19 scams.

10. How do I return Economic Impact Payments?

If you received an Economic Impact Payment for a deceased person, including a payment made to both a living spouse and a deceased spouse, you are responsible for returning the payment for the deceased person to the Internal Revenue Service (IRS). Learn more about returning Economic Impact Payments.

Source: American Bankers Association Economic Impact Payment FAQ for Customers

Posted:

04/16/2020

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)