INTRUST Safeguard Spending®

A convenient account with no overdraft fees.

Our Safeguard Spending account offers you the benefits of Free Checking without the worry of overdraft fees. Convenient features, free mobile and online tools, 24/7 easy access to your money, and no minimum balance or monthly1 service charge.

Is Safeguard Spending right for you? Compare checking accounts to learn more about our options.

Get safe and affordable access to your money

This account is Bank On certified as affordable and safe.

How is this account different from other INTRUST checking accounts?

No overdraft fees

An overdraft fee is the cost a financial institution may charge you if you spend more money than you have in your account. In most cases with Safeguard Spending, your card won’t work if you don’t have enough money in your account, meaning there’s no need to worry about overdraft fees.

Convenient eStatements

Access your monthly1 account statements through online and mobile banking. View, print, or download anytime.

Pay without checks

Use your debit card, online bill pay, and Zelle® to make purchases, pay your bills, and pay friends and family. You will not be able to write checks on this account.

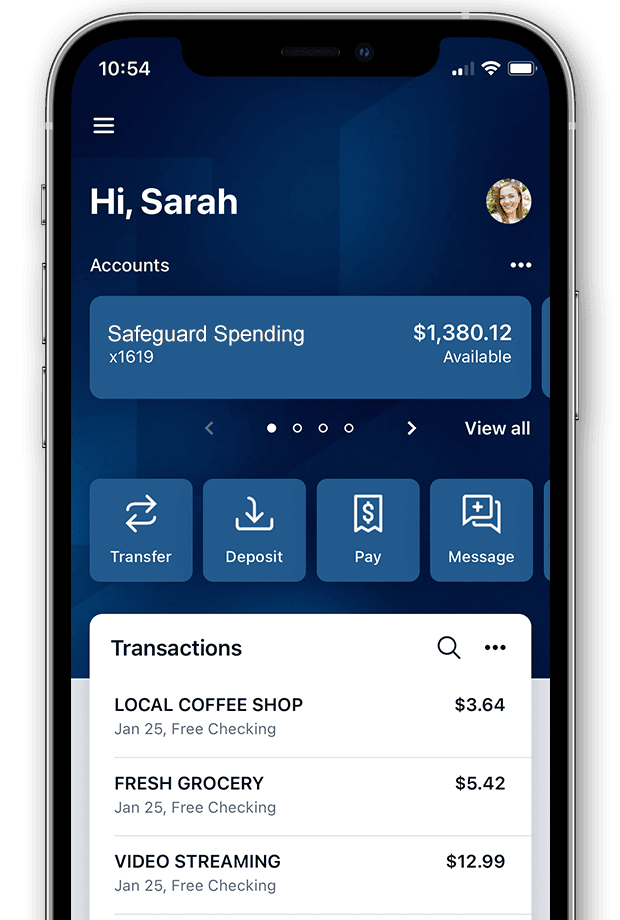

Easy-to-Use Online and Mobile Banking

Manage your account with online banking or through the INTRUST Bank mobile app. They are packed with convenient and easy-to-use features.

- View your balance

- Track your spending

- Pay all your bills

- Set up debit card notifications

- Turn your debit card off and on

- Deposit checks

- Move money between accounts

- Send money with Zelle®

Articles and Insights

Helpful resources for managing your money

Card Management: Control Your Debit Card

Eliminate Your Debt

Free INTRUST Visa® Debit Card

Get secure, convenient, 24/7 access to your cash with your contactless debit card, included with your INTRUST Safeguard Spending account. Available in exclusive Shocker and Wildcat designs.

- Tap to pay at the register with your debit card or through the mobile wallet on your smartphone or smartwatch

- Access 55,000+ surcharge-free ATMs worldwide

- Exclusive university designs

- Protection with Visa's Zero Liability Policy

Rest Easy

Your money is safe and secure

Member FDIC

Your deposits are insured up to the maximum allowable amount by the FDIC

Zero Liability

You won't be held responsible for unauthorized charges on your account

Security Tools

Set up email and text alerts and control your debit card through our mobile app

Fees and Terms

$0

Monthly1 service charge

$0

Minimum opening deposit

This is not an interest-bearing account.

This account requires enrollment in eStatements.

For additional details about INTRUST checking and spending accounts, review our Truth in Savings Disclosure for Personal Accounts, Personal Accounts Fee Schedule, Your Ability to Withdraw Funds from Your Deposit Account, and our Terms and Conditions for Your Deposit Accounts (Deposit Agreement).

1. Month or monthly is an approximate four (4) week period or cycle, not necessarily a calendar month.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

.png?Status=Temp&sfvrsn=91c53d6b_2)