Economic conditions at the start of a new decade changed significantly as the pandemic impacted economies across the globe. Although a steep recession ensued, the U.S. economy partially recovered during the second half of 2020. As the recovery continues in 2021, the U.S. faces an environment of higher government debt, rising corporate debt levels, lower interest rates, varying economic conditions across regions and industries, and higher asset valuations. Moreover, the U.S. must navigate a transition to new political leadership this year. In the following pages, our team of commercial banking and wealth management professionals evaluate these circumstances and assess what they may mean for businesses and investors in 2021.

U.S. Economy

Economic recovery — three scenarios

A few, crucial variables will likely determine how the U.S. economic recovery continues to unfold in 2021.

Key factors include:

- the extent of the virus' resurgence this winter

- the status of the job market and consumer spending

- the efficacy, adoption, distribution and safety of COVID-19 vaccines

- how the political transition affects business and consumer confidence

While a wide array of economic outcomes is possible, three potential recovery scenarios are explored below based on different assumptions.

Base case scenario:

Our base case scenario suggests the U.S. economy will expand in the 3%-4% range in 2021. We view this outcome as the most probable. It assumes:

- the virus continues to spread during the winter with some localized lockdowns

- the unemployment rate and consumer spending moderately improve in the first half of 2021

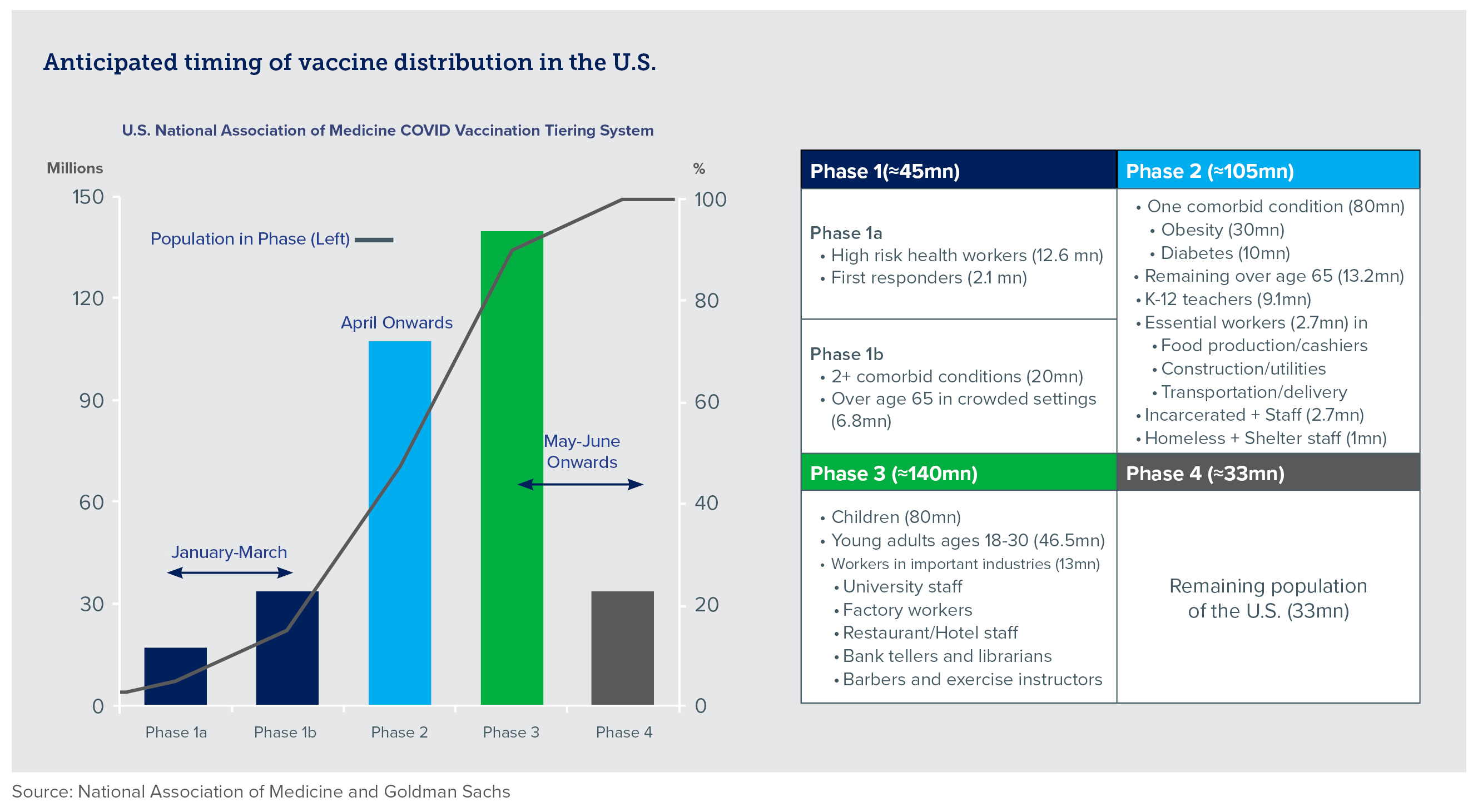

- vaccines become broadly disseminated by the summer (as illustrated below)

- political transition does not derail consumer or business confidence

These assumptions point toward a steady acceleration of economic activity through midyear as consumers willingly spend on goods and services previously foregone. This past holiday season provided evidence of increased consumer spending. Mastercard reported that U.S. retail sales rose 2.4% between November 1 and Christmas Eve compared with the same period last year. Furthermore, recently signed COVID-19 legislation and the stimulus payments to be received by many consumers will help boost the economy until vaccines become widely distributed. Our base case assumes that economic output returns to pre-pandemic levels by the third quarter of 2021. However, the recovery will continue to be uneven across industries (e.g. housing and online sales are likely to continue accelerating more quickly than travel-related sectors in 2021).

Upside scenario:

We see the potential for stronger economic growth than our base case if more favorable conditions emerge in early 2021. Recent events, such as the virus mutation in the United Kingdom and South Africa and continued federal government dysfunction, indicate more favorable conditions are less likely to occur than our base case. In this upside scenario, the U.S. economy accelerates at an annual pace greater than 4%. This outcome assumes:

- the spread of the virus slows in 1Q21 and lockdowns are avoided

- the job market and consumer spending bounce back quickly

- vaccines become widely available in early 2021

- consensus is reached on matters of national importance and consumer and business confidence improve

These assumptions lead to the U.S. economy returning to its pre-pandemic levels by the second quarter of 2021.

Downside scenario:

Although possible, but less likely than the prior two scenarios, we see the potential for a less optimistic outcome materializing. In this downside scenario, the nascent recovery stalls, resulting in sub-3% annual growth for the U.S. economy in 2021. It assumes:

- COVID-19 cases continue to accelerate throughout the winter leading to widespread lockdowns

- labor markets and consumption deteriorate

- adoption and distribution of vaccines are delayed

- a rocky political transition occurs leading to civil unrest and strained international relations

This downside scenario is characterized by a failure to significantly reduce virus transmission in the near term, causing a slower-than-expected recovery. Under this scenario, economic activity does not return to pre-pandemic levels until sometime in 2022.

Inflation

Given our base case scenario, inflation should move in tandem with the U.S. economy. Wage growth likely will remain subdued early in the year, but it may accelerate if the recovery gains momentum. Higher wages, rising commodity prices, and limited housing supply could push inflation near 2% later in the year and keep it there in 2022.

Should our most optimistic scenario unfold, these factors could produce unanticipated increases in inflation. Higher inflation, and subsequently higher interest rates, could make it more challenging to service the burgeoning amount of government debt accumulated during the pandemic or support current asset prices.

Fiscal and monetary policy

The $900 billion stimulus package passed in December 2020 provided support to unemployed workers and small businesses and facilitated vaccine distribution. These measures should help bridge the loss of household and business income until the economy more fully recovers.

Even with the likelihood of less fiscal stimulus needed this year, the budget deficit could exceed $2 trillion following a deficit of over $3.1 trillion in fiscal 2020. Senate runoff races in Georgia in early January gave Democrats control of the U.S. Senate, increasing the chance that some of President-elect Joe Biden's proposed tax increases may become law. During his presidential campaign, Mr. Biden proposed raising taxes on corporations, estates, and high-income households, reversing key parts of the 2017 tax cuts. Notwithstanding the prospects of higher tax revenues, accumulated federal deficits increase the risk of fiscal challenges for the U.S. midway through this decade.

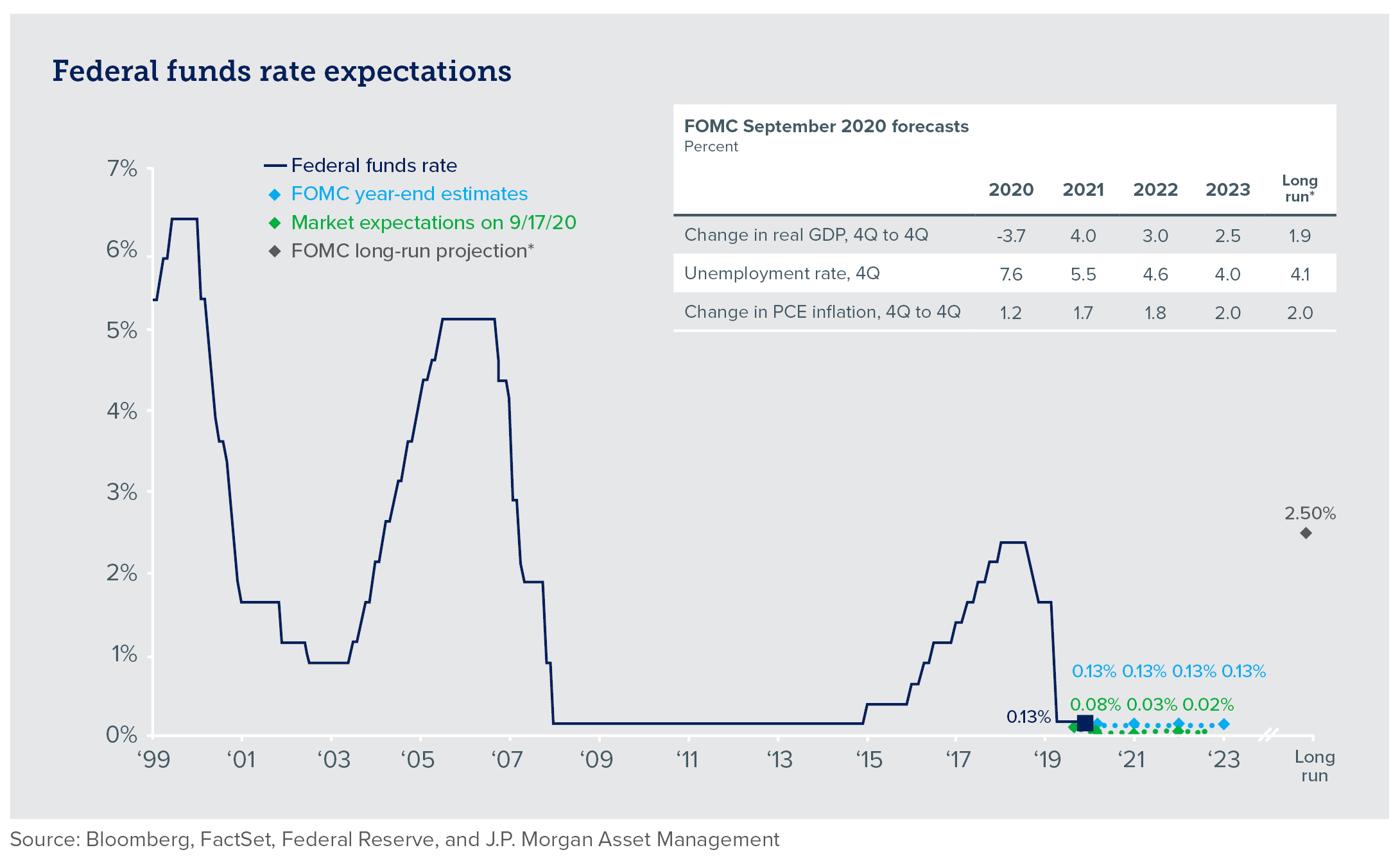

Regarding monetary policy, the Fed will likely continue with its accommodative policies, including the use of such tools as increasing the pace of asset purchases as needed and keeping short-term interest rates near 0%. Under our base case scenario, we

do not expect short-term rates to move from current levels for at least two to three years.

Regional Economies

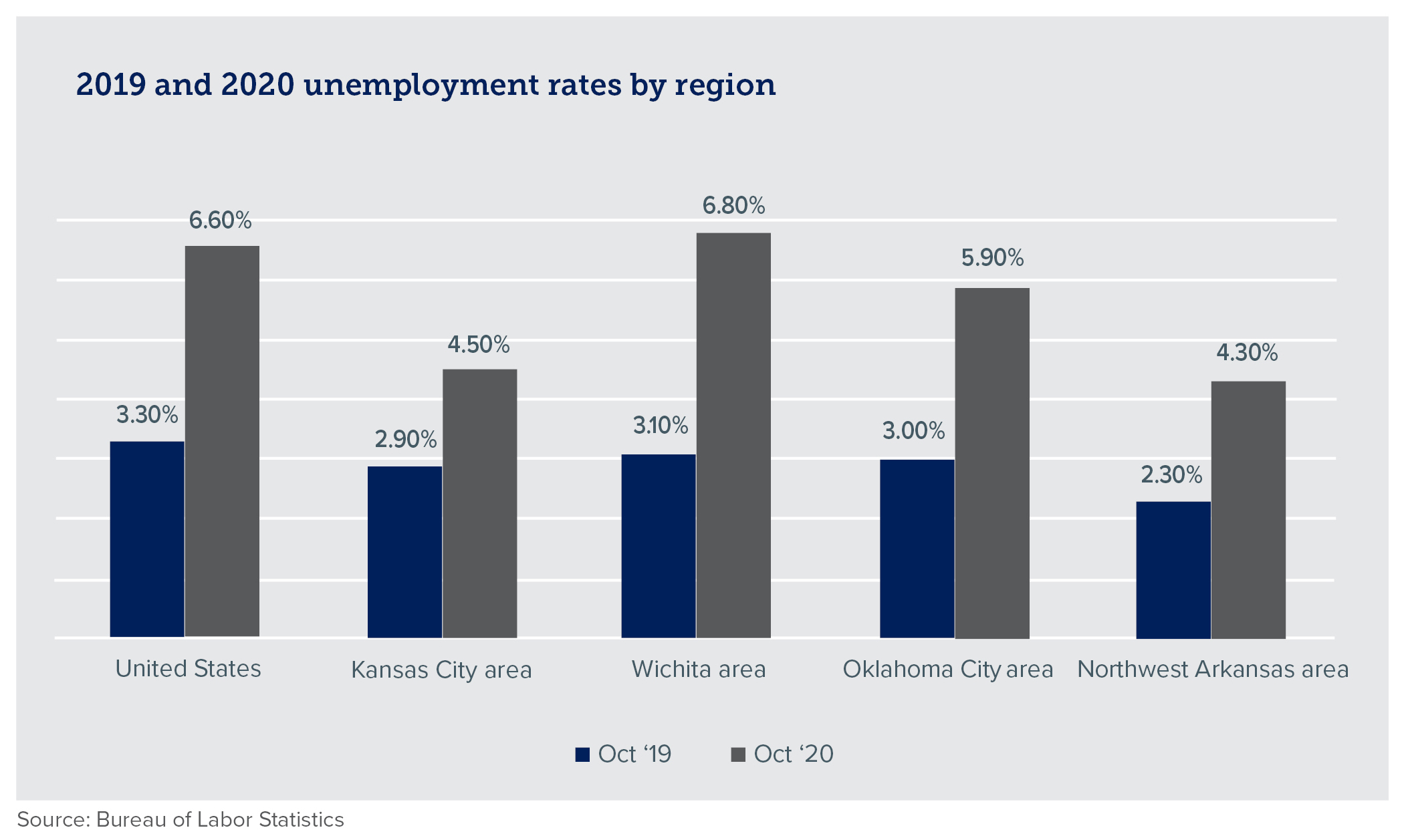

Like the U.S. economy, regional and local economies in Kansas, Oklahoma, and Arkansas experienced a sharp contraction in economic output and corresponding increases in unemployment rates from the pandemic-induced shutdowns in 2020. Subsequently, these regional economies partially recovered from declines attributable to the pandemic, but the employment picture has not yet returned to pre-pandemic levels. We expect continued growth in Kansas, Oklahoma, and Arkansas, albeit at varying degrees. We explore these regional differences in more detail below.

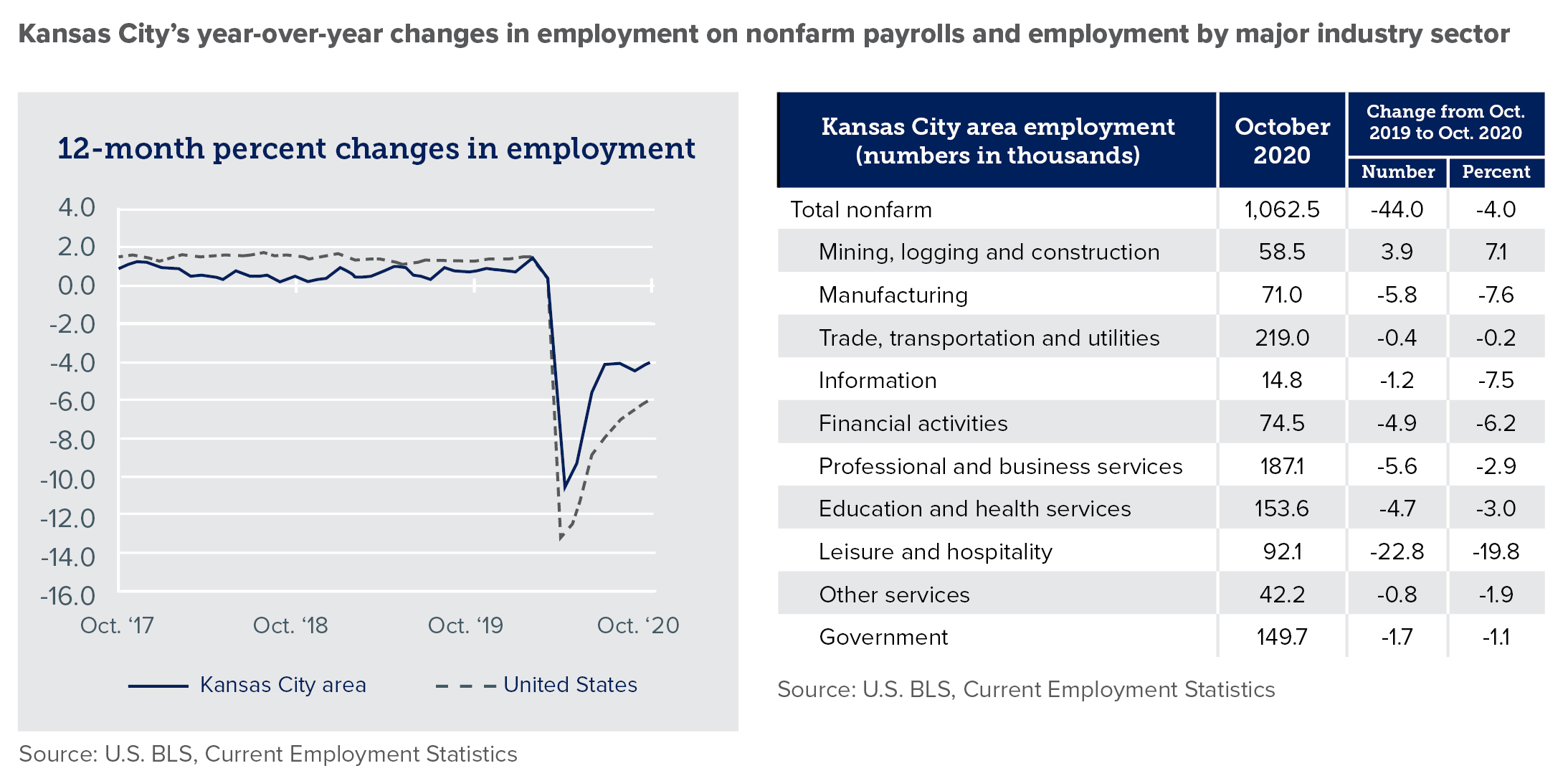

Northeast Kansas

Kansas City: The labor market in the KC metro area suffered less and recovered more quickly than many labor markets in the region and the nation. Prior to the pandemic, the area’s construction pipeline signaled strong regional growth, including ongoing downtown revitalization efforts. As the metro area recovers, construction remains relatively robust, specifically in industrial and multifamily housing. Other industries showing promise in 2021 include transportation, fulfillment, warehousing, technology, and healthcare. Given the breadth of the economic base in KC, the area is well positioned to fully recover to pre-pandemic economic output levels this year.

Lawrence

: For the last few years, Lawrence has focused on expanding its affordable housing options, helping to attract manufacturing and industrial jobs. Also, the technical training school — a private/public partnership effort — has experienced

rapid growth and has benefited from the support of the University of Kansas, the City and County, and many local businesses. Tight housing supply and somewhat restrictive local policies provide an opportunity for the city in the coming years as

it competes with nearby communities that are offering favorable incentives for businesses and stronger housing inventory to accommodate easier relocation for workers. On the contrary, new business attraction, as exemplified by a leading food manufacturer’s

decision to call Lawrence "home" for its latest manufacturing facility, may aid in the City's ability to attract additional businesses and talent to the region in the coming years. While bright spots exist, our base case suggests that growth in

Lawrence is likely to be muted over the next few years.

Topeka: The Topeka market has some momentum heading into this new year on the heels of large capital expenditure commitments from multinational and local companies, of which are expected to add strong job growth in the coming years. Local officials have initiated measures to attract businesses of all kinds to the community, and the cost of living is attractive to many companies considering relocating to the area. Walmart is investing $200 million in a distribution center in Topeka, which will provide 300 full-time jobs for the community. This project is expected to be complete in late 2021. Many of the area’s manufacturing companies experienced growth in 2020 – especially box companies for shipping and construction-related manufacturers (e.g. asphalt, concrete, roofing materials, etc.). As with most other communities, COVID has negatively impacted many people and businesses in Topeka, but the pro-growth policies of Topeka should help position the city for continued recovery in 2021.

Manhattan and Junction City: Kansas State University, the local rental market, and Fort Riley will likely be key influencers of the region’s economy in 2021. The University, like many colleges, has experienced a decline in enrollment, negatively impacting the rental market. COVID restrictions have resulted in fewer events at KSU, which have led to declines in ancillary hospitality business revenue. Fort Riley continues to play a significant stabilizing role in the Manhattan and Junction City economies.

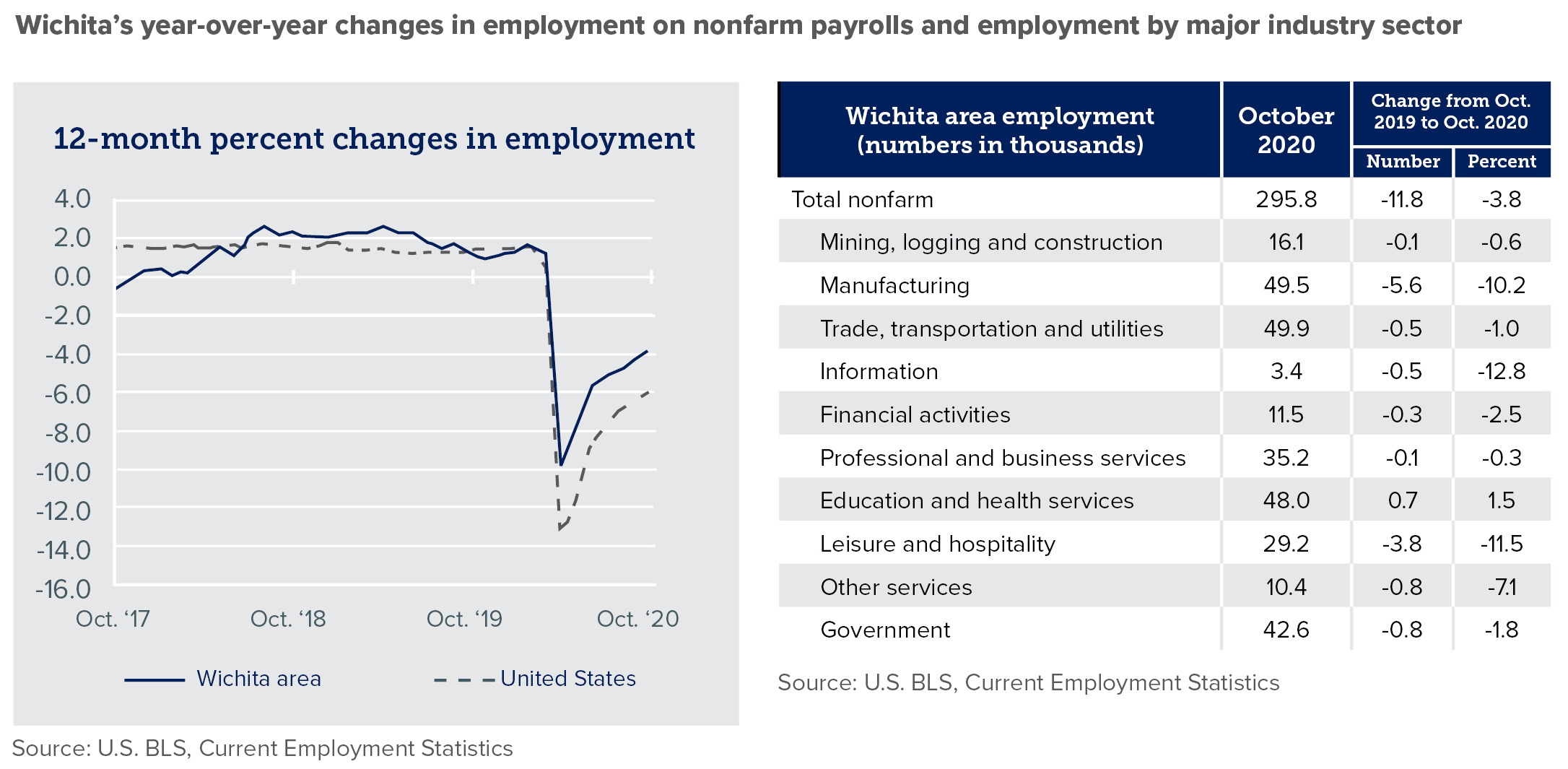

Southcentral Kansas

Wichita: The labor market in the Wichita metro was hit hard during the first half of 2020 and has subsequently lagged regional and national job market improvements. Construction, transportation, professional services, and healthcare showed the most resiliency in Wichita during the early stages of the recovery. However, given the headwinds the aircraft industry faced even before COVID, aerospace will likely be one of the slower industries to rebound, significantly impacting the local economy in 2021. Also, there is currently a surplus of planes and parts that will need to be absorbed before machine shops and Spirit AeroSystems can resume production at previous levels. One bright spot in aviation for Wichita is the FAA’s airworthiness certification of the 737 Max. Other industries in Wichita that may recover more slowly include hospitality — namely restaurants and hotels — and oil and gas. The incoming administration has voiced a desire to reduce the consumption of fossil fuels and effectively can change policies without action from Congress, adding complexity to the oil and gas landscape. Attempts to curb fossil fuel production and consumption by government has been a challenging task for prior administrations as technological innovation and advancement have outpaced policy restrictions. Also, it remains to be seen how the new administration’s policies may impact global trade. Our regional economy will obviously be focused on any trade issues that might affect agricultural exports. The City has taken steps to diversify the region’s employment base by identifying non-correlated industry growth clusters that complement the existing talent pool. Amazon’s recent commitment to the South-Central region is a notable example of diversified job growth (outside of aircraft) and is likely to attract connected suppliers leading to further job creation in the coming years. One of Wichita’s largest non-aircraft manufacturing employers has committed to adding approximately 300 jobs, aiding with the local economy’s rising unemployment statistics. Considering each of these factors, Wichita’s economy will likely continue to recover in 2021, albeit at a slower pace than some of the other faster-growing communities in the region.

Newton: With Newton’s proximity to Wichita, many residents work in the Wichita area in various manufacturing businesses, including those tied to aviation. Accordingly, Wichita’s aerospace ups and downs also have an

impact on the Newton economy. Any slowdown in production has a ripple effect on the community. Furthermore, numerous locally owned businesses were adversely affected by the 2020 shutdowns, having limited resources and lacking the ability to make adjustments

or accommodations to social distance standards. The latest round of stimulus passed in December should help buoy these small businesses during the first half of the year. Healthcare will likely be a key driver of growth for Newton in 2021 and beyond.

Butler County: Construction is a bright spot in all areas of the County. Local builders are stretching their capacity limits, finding their backlogs full well into 2021. Mortgage rates are low and create a seller’s market on real estate. Area home inventory is very low. Another positive contributor to the region’s economy is El Dorado Lake, which was at maximum capacity during the summer of 2020 and generated record tax receipts despite the COVID shutdown. Additional potential exists for the lake that may be tapped later in 2021, including private investment and corporate development opportunities. In contrast, oil and gas — a significant industry in Butler County — has struggled recently and may be further impacted by changes to fossil fuel policies of the incoming administration. The agricultural economy is another industry in Butler County that has experienced some recent challenges. The balance of these factors should provide the continuation of a moderate recovery for the County in 2021.

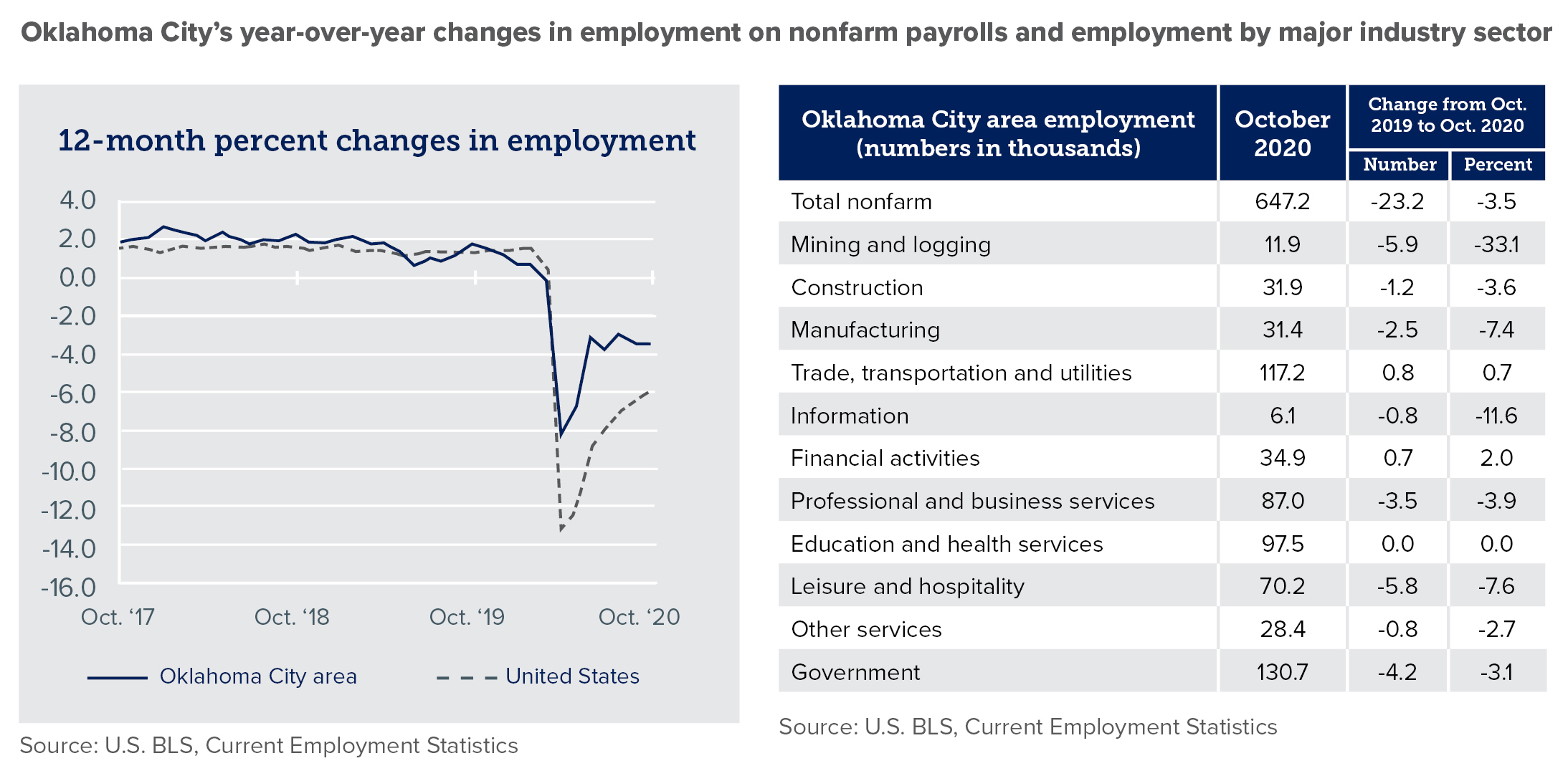

Central Oklahoma

Oil and gas, Oklahoma’s largest industry, has been presented with numerous challenges over the last two years but, despite policy changes and low oil prices, the City has remained relatively unscathed. While oil and gas remains the leading employment sector, approximately half of the labor force is anchored by government, defense, education, and healthcare workers which offset the pronounced private sector energy volatility and enable the economy to withstand instability. Although challenges persist for the oil and gas sector, growth opportunities are elevated as asset valuations are compressed. Aerospace, the second largest industry in the region, faces headwinds as travel is curtailed amidst the pandemic leading to downstream effects on jobs in the local market. Oklahoma is the home to the largest commercial maintenance, repair, and overhaul (MRO) companies and the largest military MRO. Also, Oklahoma is home to several military bases with Tinker Air Force Base being the largest and most dominant. As the leading military MRO, it continues to do quite well. The commercial and military MROs should return to normal operating levels as the recovery strengthens, providing central Oklahoma with significant economic opportunities. Commercial real estate occupancy rates have declined over the past year in Oklahoma, specifically in the office, hotel, and retail space. However, the residential and multifamily markets continue to be strong due to low interest rates. New homes are selling at historically high rates, and demand remains significant. If consumer confidence increases as the vaccines are distributed, travel will likely increase, benefiting Oklahoma’s aerospace, tourism, and hospitality industries in 2021.

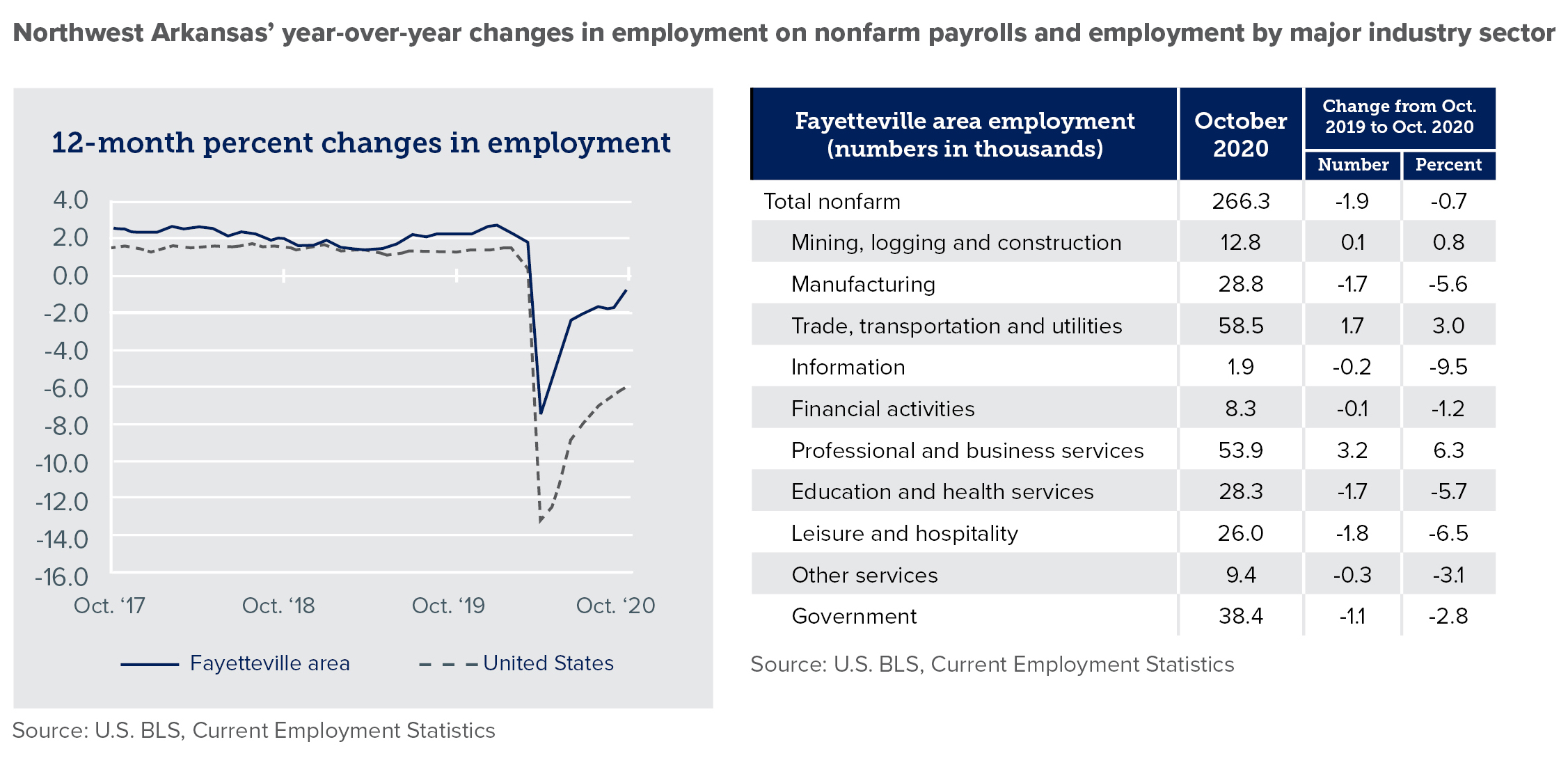

Northwest Arkansas

The labor market in Northwest Arkansas (NWA) withstood the 2020 recession better than the Kansas and Oklahoma markets, and the region’s unemployment rate has rapidly fallen — aided by the economic resilience of NWA. Walmart, with its corporate headquarters located in Bentonville, has weathered the pandemic well and is experiencing strong growth in online sales. The trend in the retail industry toward online consolidation appears to have escalated and will likely continue. Although Walmart did lay off some workers last year, the retailer brought back divisions from other parts of the country to Arkansas. Also, as Walmart accelerates its shifts toward online distribution, the type of employee they need is changing. These decisions have a ripple effect through the supplier community, which supports the giant retailer. One such example is the job gains among professional and business services, buoyed by Walmart’s growth. As the NWA economy gains momentum, the region’s population continues to grow, and the demand for housing is high. Builders and developers are picking up the pace. There is currently a severe shortage of available lots to build and very little existing housing supply, contributing to the area’s rise in home prices. Overall, the 2021 economic outlook for NWA looks quite promising. Employment growth is likely to continue throughout the remainder of the year, fueling demand for additional services of all kinds and a robust real estate market.

Investment Outlook

Our outlook for investment returns in 2021 and beyond is cautiously optimistic. Given our moderate economic growth expectations and forecast of low interest rates, we expect lower returns from equities over the next 10 years than generated in the previous decade. Moreover, the low interest rate environment is likely to create headwinds for fixed income investments for the foreseeable future. However, the Federal Reserve’s accommodative stance could very well provide a level of support for asset prices in 2021.

Equities

The year 2020 was a memorable year for U.S. equities. After plummeting 34% in the first quarter, the stock market experienced its fastest rebound ever, posting a series of all-time highs in the third and fourth quarters. Multiple rounds of fiscal stimulus and the Fed’s accommodative monetary policy response fueled the equity rally, as investors looked past the pandemic and its near-term impact on the economy.

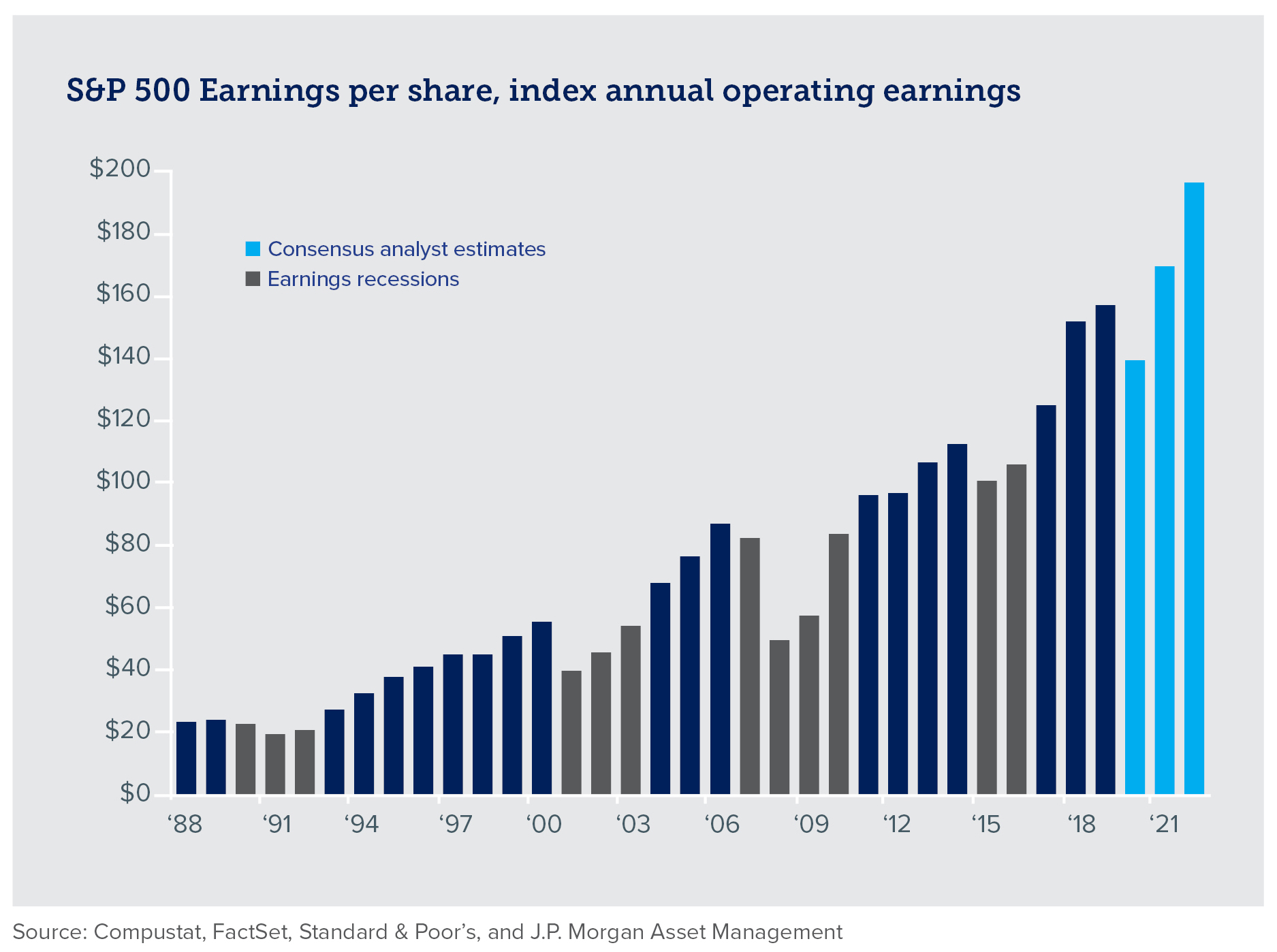

With the backdrop of a sustained economic recovery, corporate earnings are likely to see a strong bounce in 2021. Operating efficiencies gained during 2020 should also contribute to a positive earnings environment this year.

Earnings should bounce strongly in 2021

Turning to valuations, the S&P 500 index appears to be at the upper end of its fair-value range, as measured by the cyclically adjusted price-to-earnings ratio, also known as the CAPE ratio. This ratio is a common valuation measure that uses inflation-adjusted earnings per share over a 10-year period to smooth out variations in earnings over a full business cycle. Applying this valuation method to other areas of the global market, we find that developed international equity markets, value stocks, and small-cap equities appear more attractively valued than their growth and large-cap counterparts in the U.S. as of September 30, 2020. During the fourth quarter of last year, small-cap stocks, as measured by the Russell 2000 index, posted a strong rally, subsequently narrowing the valuation differences between large-cap and small-cap stocks.

Equity valuations

In a reversal of a decade-long trend, international equities may be positioned to outperform U.S. stocks, fueled by lower valuations and higher dividend yields. Historically, international stocks trade at a valuation discount to U.S. stocks. However,

this valuation gap has widened significantly, now sitting at a 23% discount versus the 20-year average discount of 13% (MSCI ACWI ex-U.S. index versus the S&P 500 index). International stocks, also, provide a 2.8% dividend yield compared to 1.7%

for U.S. large-cap stocks. Furthermore, if the U.S. dollar depreciates as expected, international equities should receive an additional currency boost to total returns for U.S. investors.

Given the long period of outperformance of U.S. large cap equities and growth stocks, excessive concentration risk may exist in some portfolios. Considering such risks and the more attractive valuations of non-U.S. equity markets and value stocks, diversifying equity portfolios is a sensible strategy in this environment.

Fixed income

In 2020, the Fed adopted a new average inflation strategy, permitting their inflation target to exceed 2% for some time to offset the persistently low inflation of the past decade. Also, last year, the Fed signaled its intention to maintain a near-zero federal funds rate until inflation surpasses 2% and the economy has reached full employment. As shown below, Fed projections and market expectations imply short-term rates will remain near zero until 2023 or later.

Federal funds rate expectations

With expectations of interest rates and inflation staying lower for longer, fixed income yields will likely remain muted for the foreseeable future. As the economy continues to rebound, investors should still be fairly compensated for assuming credit

risk, making investment grade corporate bonds comparatively attractive to U.S. Treasury bonds and agencies. Also, high quality municipal bonds remain a viable alternative to taxable bonds for high-tax-bracket investors.

Although future returns for fixed income appear low, the events of 2020 reaffirmed the diversification role that bonds play in a portfolio. Indeed, core fixed income helps to protect against equity drawdowns and still plays an important role within portfolios. We encourage investors to view bonds from a risk-mitigation perspective rather than a source of excess returns in portfolios in 2021.

Portfolio Considerations

Despite surprisingly strong market returns, most people were glad to see 2020 come to an end. With vaccine distribution underway, 2021 offers the promise of a return to more normal conditions. However, there is little doubt the coronavirus will continue to impact our lives in 2021. We are hopeful that the current recovery is the start of a sustained economic expansion.

Given the recovery’s uneven pace across regions and industries, high asset prices, and the extraordinary fiscal and monetary policies put into motion last year, investors face many challenges to navigate this year. As previously noted, high quality fixed income still serves as a stabilizer in portfolios, even with low rates. Also, having exposure to equities is as relevant as ever, although a focus on valuations is essential. Investors should consider allocating a portion of their equity portfolios to less expensive parts of the market such as value stocks as the economy continues to recover. Compelling values also exist outside of the U.S. International equities appear cheaper than their U.S. counterparts, creating the potential for enhanced returns.

The year 2020 has shown us yet again the importance of a diversified investment strategy. With the post-COVID-19 world yet to emerge, investors should take the long view, constructing well-diversified portfolios that can weather whatever conditions may unfold.

The INTRUST 2021 Economic Outlook is the consensus of the INTRUST Bank, N.A. (“INTRUST”) Investment Strategy team and is based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The forward-looking perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

01/12/2021

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)