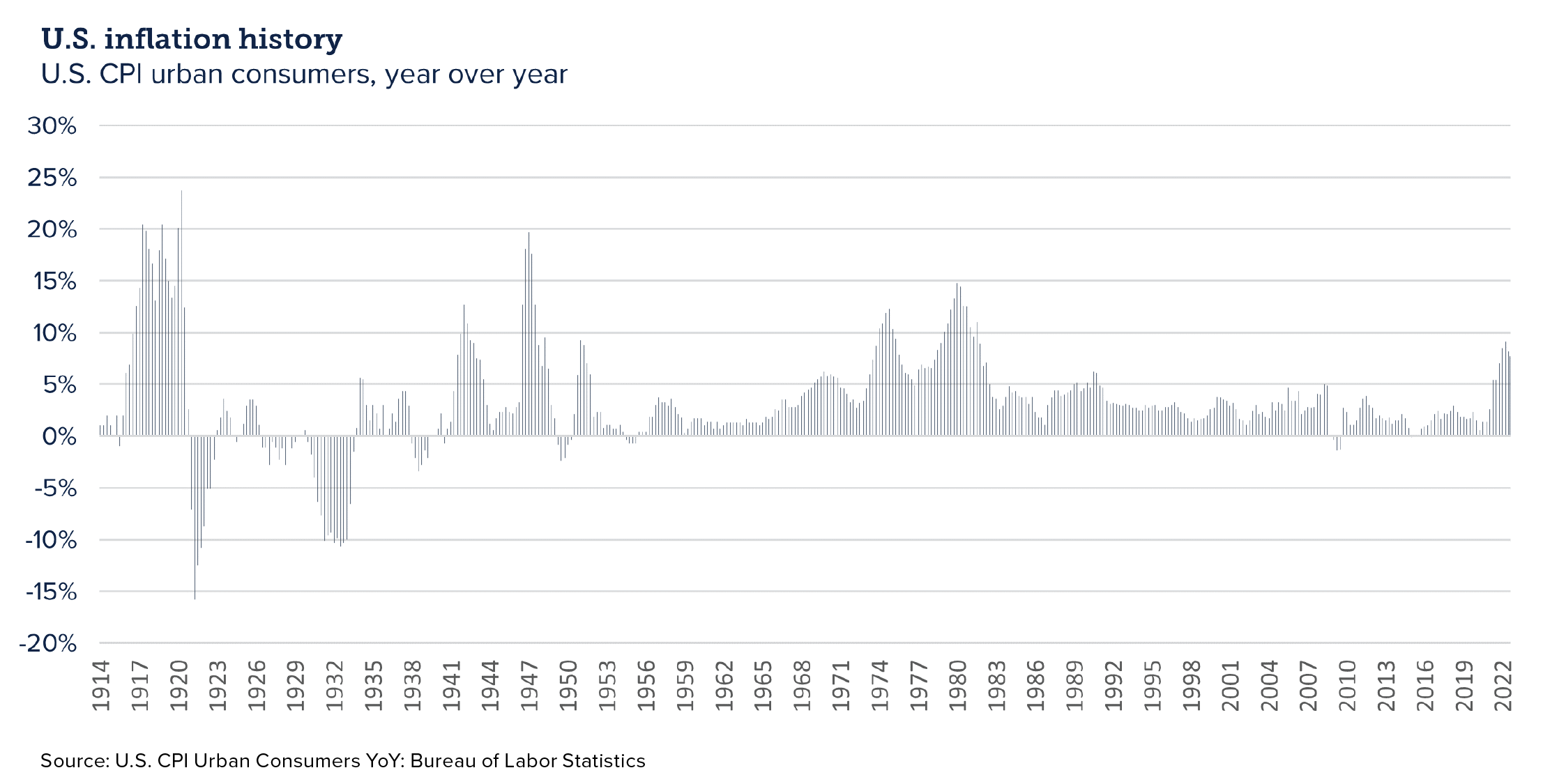

2022 will be remembered as a year when inflation dominated the economic landscape for the first time in decades. Strong consumer demand stressed fragile supply-chains, and the Russian invasion of Ukraine severely impacted the global food and energy markets. Reactions from central banks, particularly in the U.S., have been historically swift, and as we move into 2023, inflation is slowly decreasing. The probability of a global recession in 2023 remains elevated as central banks manage the delicate balance of appropriate monetary policy. In the following pages, we evaluate the current economic environment and its implications for businesses and investors.

U.S. economy

The paths forward — three scenarios

Inflationary levels not seen since 1980 spurred the Federal Reserve Bank (Fed) to aggressively increase interest rates in an effort to slow inflationary pressures. While pockets of disinflationary conditions may arise, the Fed will be careful and persistent as it works toward reducing consumer inflation to a targeted 2% level, with the goal of keeping the economy out of a broad recession. We look at three economic scenarios that could play out as the economy slows to a pace below historical averages.

Scenario 1 (Base case): Disinflation coupled with unemployment rising modestly and a mild recession

Our base case scenario, and strongest likelihood, suggests a slowing of the pace of price inflation, a condition known as disinflation. It is important to note that in an environment of disinflation, consumer prices continue to increase, albeit at a slower pace than in 2022. In this scenario, we see the year-over-year rate of inflation slowly falling throughout 2023, but with variations within the different sectors of our economy. This scenario assumes the following conditions:

- Unemployment rates rise modestly above 4% but remain below 5%.

- The war in Ukraine does not escalate into a broader conflict.

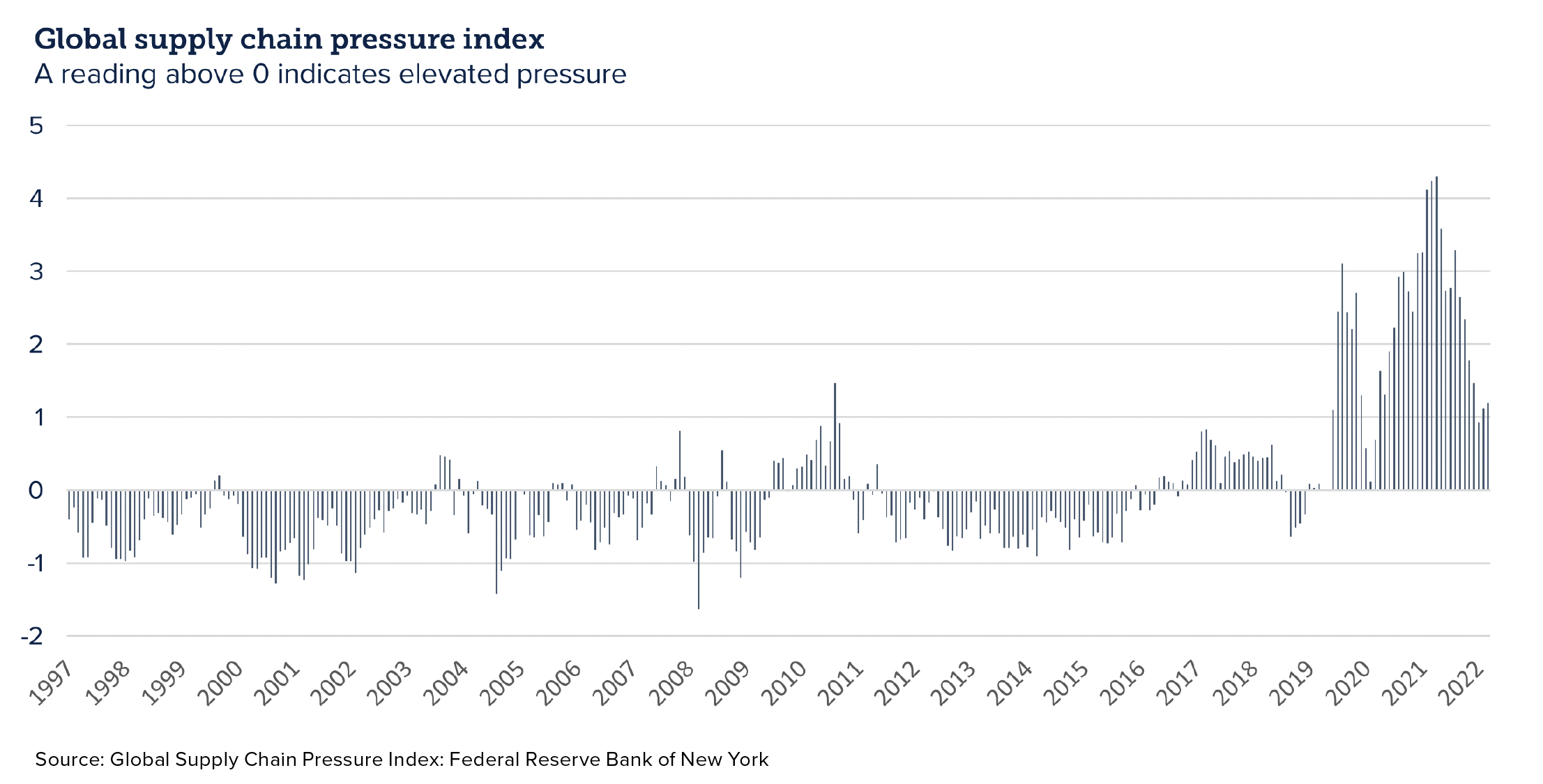

- Supply chain constraints continue to resolve.

- The impacts of swift monetary policy changes in 2022 begin to take effect and place the U.S. into a mild recession.

These assumptions point to continuing consumer demand, albeit with less buying power, but enough to keep prices moving modestly upward. Our base case does not assume inflation will reach the Fed’s target of 2% in 2023, but rather that the rate of inflation will continue to move toward the target. Moreover, our base-case scenario would indicate the oncoming of a recession with elevated unemployment and pockets of persistent inflation.

Scenario 2: A soft-landing as characterized by a mild uptick in unemployment, controlled inflation, and narrowly avoiding recession

In our second scenario, the year-over-year rate of inflation falls, the economy narrowly avoids a recession, and unemployment rates remain low. We see this scenario as temporary and simply as a continuation of our current economic trajectory of falling inflation and slow economic growth. This scenario would be accompanied by falling energy, food, and shelter prices. Energy has already begun to move in the right direction, but food and shelter continue to remain on an elevated course. Data on producer and consumer prices indicate these constraints are easing; however, unexpected shocks can have long-term ramifications on inflation expectations as the world adjusts to the new geopolitical norm.

Scenario 3: Stagflation characterized by persistently high inflation, unemployment above 5%, and a deeper recession

Stagflation, or recession-inflation, is characterized as slowed economic growth coupled with high unemployment in an environment of elevated inflation. In this scenario, workforce cutbacks put the job market under pressure and corporate revenues decline. Consumers pull back on spending as inflation continues to eat away at their purchasing power and confidence in the economy falls back to historical lows. While this scenario is possible, we view the historically high ratio of job openings to job seekers as a key component to keeping unemployment from elevating too rapidly and, therefore, giving this scenario a low probability.

Key themes shaping our outlook

Cracks in consumer and business strength

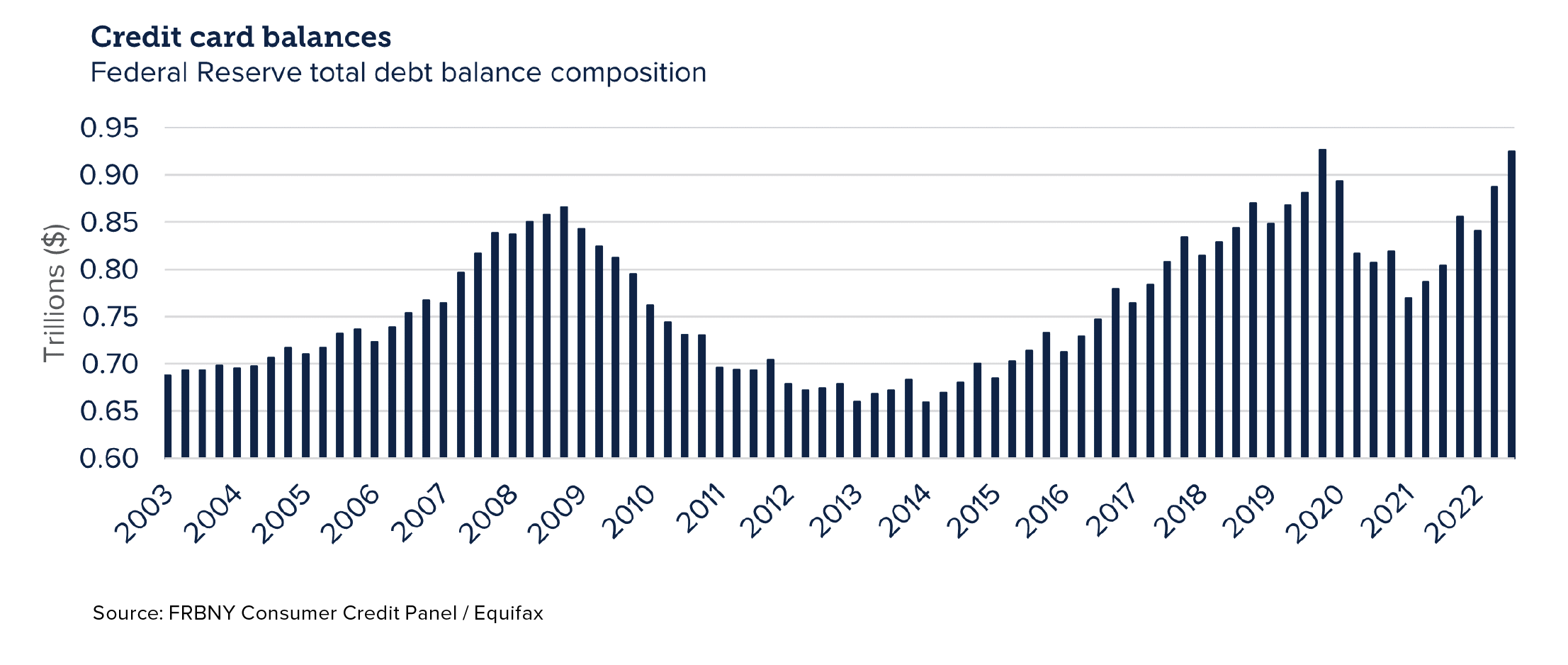

An underlying theme for our forward-looking view of the economy is the fiscal position of both the average U.S. consumer and U.S. businesses. Any discussion of the U.S. economy must include a look at consumer strength, as consumer spending represents approximately 70% of our economic growth. As a result, consumer confidence and sentiment readings serve as reasonable economic growth barometers. Significant stimulus payments received by most consumers during the pandemic, coupled with considerable uncertainty about the future, resulted in improved household balance sheets as consumers held on to stimulus payments and paid down debt in 2021. We saw these trends reverse somewhat in 2022 with excess savings beginning to decline and credit card utilization increasing. The lagging effects of monetary policy also began to weigh on consumer strength throughout 2022 as both “confidence” and “sentiment” readings show signs of deterioration.

Further, American corporations appear well-positioned as earnings grew in 2022. However, debt service implications as a result of monetary policy actions combined with tight labor conditions are likely to place pressure on corporate margins as we enter 2023. As with the average consumer household, businesses are entering 2023 in a position of relative strength, and while we foresee a more difficult operating environment ahead for businesses, particularly in light of a possible recession, we believe that balance sheets are more adequately prepared for resilience than with prior recessions.

The delayed impacts of monetary policy

The Fed’s response to inflation was robust and abrupt in 2022. The Federal Open Market Committee (FOMC) raised the federal funds rate by 425 basis points in an effort to control inflationary pressures. Rate hikes of this speed and magnitude far exceed those of recent periods of quantitative tightening and, as such, the consequences of said actions are “to be determined.” In addition to rate hikes, the Fed’s balance sheet reduction program helped to push mortgage rates higher, resulting in an abrupt slowdown in housing demand toward the latter parts of 2022. Typically, there is a lagging effect of 12 to 18 months between the initiation and results of monetary policy actions. In turn, the market then began to push longer-term yields lower (inverting the yield curve) in anticipation of a slowdown in growth. As a result, our outlook calls for 2022 policy impacts to begin to fully impact the economy toward the middle of 2023, at which time we see recessionary fears begin to set in.

The economy picture overseas

Inflationary pressures have not been limited to the United States. Countries across the globe have also battled supply chain constraints and labor shortages. In addition, the Russian invasion of Ukraine, China’s zero-COVID policy, and a push for de-globalization has made economic recovery overseas significantly more difficult and slower. The impacts of the Fed’s monetary policy regime have also been felt globally as currencies across the world saw considerable devaluation against the dollar (the world’s reserve currency), adding extra challenges to international trade. Below we highlight some of the destabilizing factors, applying a risk component to each.

Food and energy

The Russia-Ukraine war has had its most pronounced economic impacts in the areas of food and energy. Ukraine and Russia account for approximately 10% of the world’s grain production. Grain shipments, which must now be borne by other nations, are expected to keep inflationary pressures elevated as these critical global grain producers remain entwined in war. In addition to food supply constraints, Europe is also facing an energy supply shortage caused by the Russia-Ukraine war and retaliation from Russia in response to international sanctions. Domestically, energy policy is pushing investment towards decarbonization, and the long-term ramifications of this are unknown but likely to keep energy prices higher in the near term as petroleum companies pull back on expansion in this unfriendly environment. Higher energy costs cast a wide inflationary net on everything from home heating to transportation.

China's regulatory environment

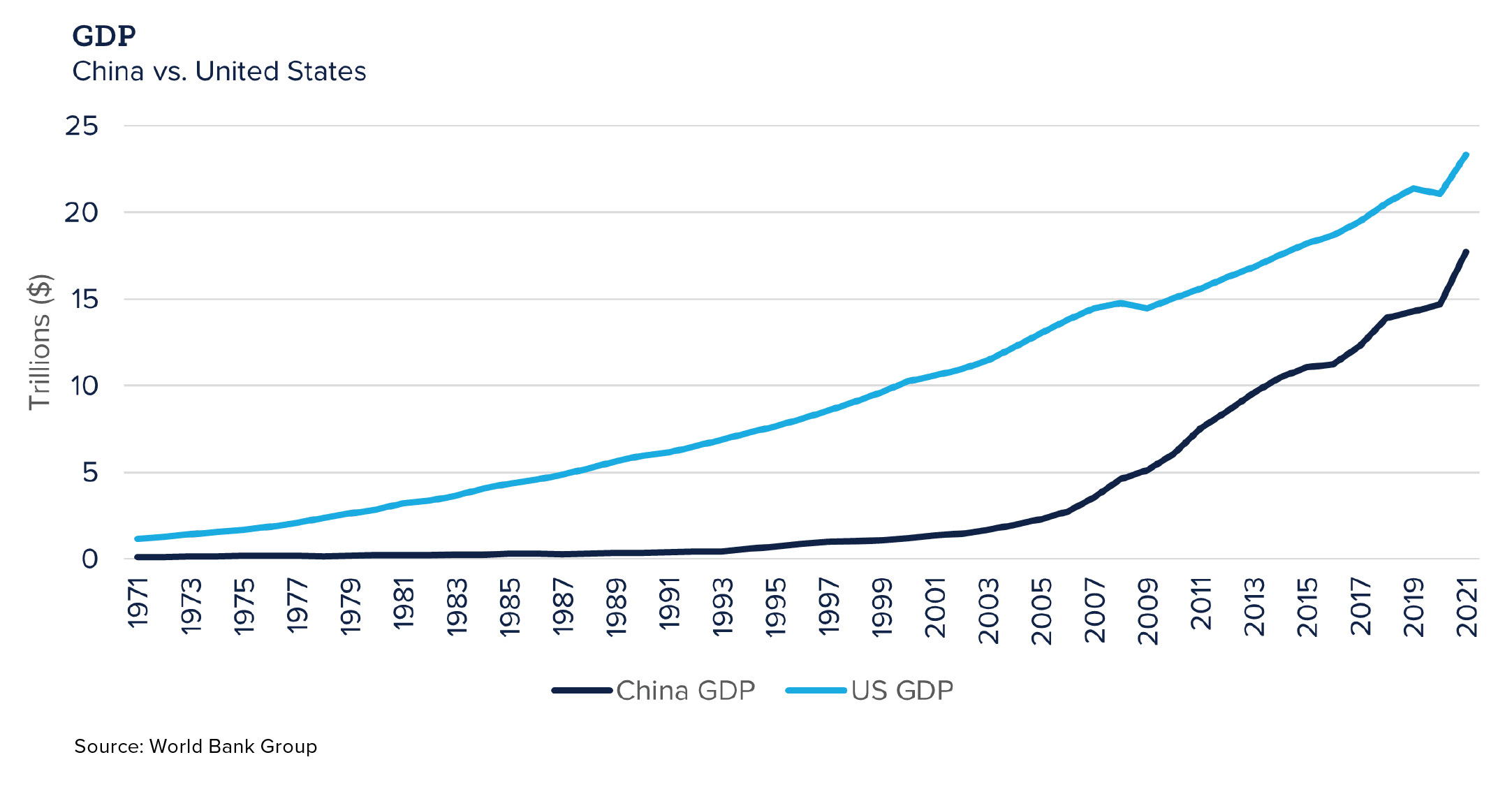

China’s zero-COVID policy, as well as its regulatory crackdown on many industries and large businesses, has had a negative effect on the nation’s economy and, subsequently, the global economy. COVID precautions have disrupted China’s supply chain and slowed the growth of its middle-class consumer base. While most of the world was adapting to life with COVID, China’s policies have led to the country largely avoiding the disease, but as these restrictions ease, outbreaks could cause large scale disruptions. These policies will likely lead to further evolution of global trade as countries move more of their production capacity onshore and establish multiple supply chains for their much-needed resources. China is currently the world’s second largest economy, so its economic policies will create a wide ripple effect across the globe.

Potential China-Taiwan crisis

Xi Jinping, President of China, has been clear in his view that Taiwan is a breakaway province that will eventually be under Beijing’s control. Tensions between the two countries are high as China has exerted its presence in the region by flexing its military might. While we view a Chinese invasion of Taiwan as unlikely, it remains a significant wildcard which could have a very disruptive impact on world markets.

Regional economies

As with previous INTRUST Economic Outlooks, we take a close look at our regional economies. Overall, we have a generally positive outlook for our markets, but overall economic concerns in the U.S. generate a level of uncertainty that could impact our region.

The economic landscape in a majority of our regional markets is positive, yet constrained, with many companies and municipalities scouring the country for labor. The labor picture continues to play a large role in any discussion of post-pandemic economic recovery. The rapid response to the COVID-19 pandemic sent unemployment rates to historic levels followed by a recovery that was almost as rapid. But while employment has improved, the labor participation rates across a significant portion of our workforce have not fully recovered to pre-pandemic levels. A shortfall in the older population has been largely attributed to earlier-than-expected retirement for much of this segment. Causes for the lower participation by younger workers are varied and numerous and range from lack of available childcare to higher participation in the so-called gig economy. Regardless, the amount of job openings has quickly outpaced any labor trends, signaling that companies will have an uphill battle to meet their labor needs. Employee retention and recruitment, as well as automation, will play a key role in economic growth, both in the short- and long-term outlook.

South Central Kansas

Wichita: Wichita’s economic prosperity has long been correlated with the aerospace industry and, heading into 2023, the prospects of further employment growth in this sector appear to show signs of positive momentum. Outside of aerospace, the region’s general employment picture is positive and recently peaked at new all-time highs in late 2022.

Wichita struggled with a declining labor force trend from 2009 to 2017 while employment figures trended upward – leading to a low unemployment rate. The labor force trend reversed in 2018 and 2019 returning the labor participation rates to previous levels; however, the pandemic stunted any momentum that the local economy was experiencing. As a result, this sets up the projection for Wichita into 2023 to be one with tight labor market conditions and heightened wage pressures. As with the nationwide economy, monetary policy implications and increased lending rates may complicate the story for small businesses as they battle with both labor pressures and borrowing costs. Overall, we believe the projected positive momentum coming from aerospace will be dampened by the aforementioned risks resulting in mild 2023 growth.

Newton and Harvey County: Manufacturing labor continues to be an issue for this region as many employers experience high demand for their products. Higher agricultural commodity prices should help fuel growth in this industry throughout 2023. The decision by a leading roofing shingle manufacturer to expand into the region will provide hundreds of new jobs once the plant is at full capacity. Growth in the healthcare industry continues with expansions occurring at the north end of Newton. Economic activity in Newton remains closely tied to Wichita, and as both cities continue to expand, that connection becomes stronger.

El Dorado and Butler County: Butler County continues to grow in both business activity and population. Andover’s population increases are largely attributed to quality of life, new housing construction, and the reputation of the school district. El Dorado is attractive to industry, primarily due to the abundant water resource in El Dorado Lake. Butler County recently announced a project to build a convention center, replacing the former Park City facilities near I-135, and Butler Community College has expanded to attract more students. Home inventory has limited population growth, particularly in El Dorado, and as Wichita continues to expand, home builders are increasing development in Butler County.

Northeast Kansas

Kansas City: Kansas City continues to benefit from its diverse economy, which has produced high confidence within the business community. The new Panasonic plant is considered a huge win for the area and will foster a tighter bond with Lawrence and Topeka. The KC Area Economic Development Council has been very active in attracting additional business. Kansas City International Airport will complete a $1.5B expansion, slated to open in 2023, which should increase traffic through the airport and region. The business supply chain has improved following the pandemic but issues still remain, particularly with transportation. The recent merger between KC Southern Railroad and Canadian Pacific will likely increase freight traffic, straining the supporting transportation infrastructure. The housing market remains robust as families move to the area.

Lawrence and Topeka: Both communities are reaping the benefits of concerted efforts to increase development. Perhaps the biggest economic news for the area will be the construction and operation of the new Panasonic lithium-ion battery plant in De Soto, KS, just east of Lawrence. Construction of the facility will provide thousands of jobs over the next few years and, once operational, the $4B plant is projected to provide 4,000 direct jobs and another 4,000 indirectly. In addition, the two communities continue to pour support into their universities. Incoming freshmen enrollment is up at the University of Kansas in Lawrence, creating a need for additional student housing. And Topeka is providing considerable support to Washburn University, particularly in its technical training and law colleges. Manufacturing industries have been strong, but a shortage of qualified workers could impact future growth prospects in the manufacturing sector.

Manhattan and Junction City: These communities are seeing meaningful business growth as they emerge from the pandemic shutdown three years ago. In a nod to the influence and impact of Kansas State University, recent significant business additions include Scorpion Biological Services and the National Bio and Agro-Defense Facility (NBAF). In Junction City, the recent merger of Geary Hospital and Stormont Vail Health should provide a stable source of healthcare investment for the near future. Fort Riley continues to provide a significant economic impact to this community, particularly felt in the areas of housing and local service-oriented businesses. A significant percentage of the jobs in this region are government jobs, which can provide some economic stability.

Oklahoma

Oklahoma City: Labor constraints have impacted Oklahoma particularly hard as the region is experiencing strong economic growth. The oil and gas industry remains the largest in the state and has enjoyed a strong boom in activity due to higher energy prices. Additionally, as Oklahoma seeks to diversify its economy, a concerted push from state and local government to attract aerospace industries has further strained labor availability. Focused gains in the healthcare industry are bringing more jobs to the region. Oklahoma City’s central location and access to three major interstate highways ensure robust growth in logistics industries. In order to help fill the demand for employees, state and local legislation offers incentives for individuals to relocate to the state. Housing costs are moderating as the building supply chain issues brought by the response to the pandemic improve.

Tulsa: The Tulsa area is seeing strong economic growth coming out of the pandemic, particularly in areas other than oil and gas, which has historically been the linchpin of the regional economy. The city of Pryor, which is located on the northeast side of Tulsa, has started the genesis of a manufacturing corridor focused on electric vehicle components. Canoo announced the construction and operation of a lithium-ion battery plant, and other support businesses are moving into the area. Other technology firms, such as Google and Amazon, are expanding their footprint in the area, creating a high demand for workers. American Airlines remains one of the largest employers in the Tulsa area, and its outlook has stabilized coming out of the pandemic. The healthcare industry continues to expand as the three major hospitals have added capacity and services. As in other regions, a lack of affordable housing remains an issue, one that is made more pronounced as the need for workers increases.

Northwest Arkansas

Northwest Arkansas (NWA) continues to record economic growth as the region is viewed as an attractive environment for businesses and personal living. Walmart, headquartered in Bentonville, AR, has made significant investments into their footprint in the area, bringing in additional jobs both directly and indirectly. Similarly, Tyson is moving its corporate office from Chicago to Rogers, AR. The region is seeing the development of a healthcare corridor with recent additions or expansions from Whole Health, Washington Regional, and Mercy Hospital. Perhaps the most significant economic risk for NWA are the pains that accompany too-rapid growth, such as strains on infrastructure and elevated housing costs.

Investment outlook

While 2022 brought some of the most difficult market conditions in years, we believe market fundamentals point to a more attractive market environment. Markets are forward looking, meaning much of today’s news and worries are already reflected in prices. Therefore, long-term expectations for market returns have moved significantly upward across almost all asset classes. While we do expect volatility to remain elevated in the new year, it is paired with an improved opportunity set of investments. This should benefit all investors, improving financial plans that have been negatively affected by this year’s returns.

Equities

Valuations compressed significantly in 2022 as bond yields rose and inflation concerns gripped the markets. Stock prices fell 20-30% across most of the equity asset classes as global recessionary fears materialized. But corporate earnings remained robust and, in some cases, saw new highs as companies were able to pass higher input costs on to an exceptionally healthy consumer base.

Our outlook calls for downward pressure on corporate margins and earnings. As with much of the recovery, market fundamentals will vary by sector and market volatility will likely remain a staple throughout 2023.

As for international markets, the story is much the same as with the U.S., but with the added variability associated with geopolitical risks. The strength of the U.S. Dollar has hurt the performance of international equities for U.S. investors, in some cases doubling the net negative performance U.S. investors faced in 2022. As the world’s reserve currency, the strength of the U.S. Dollar will play an outsized role in the performance of international equities for U.S. investors.

Fixed income

A key byproduct of the Fed’s rapid increase in interest rates has made bonds a viable income source for 2023. Fixed income investors who have been plagued by low-yielding fixed income investments for more than a decade now face an environment of high-quality bonds with meaningful yields.

Eyes will be on the Fed in early 2023 as it begins to slow down the pace of rate hikes. Fed policy will continue to affect returns in the fixed income market; however, today’s yields provide a strong base of returns, which contrasts with the yields of early 2022. This should create a cushion for fixed income returns in the event of higher rates if the Fed struggles to contain inflation and must prolong its rate hiking program.

High yield fixed income is also benefiting from an increase in yields for investors. Today’s default levels in high yield fixed income are at historic lows as healthy company balance sheets have resulted in an increase in credit quality. If inflation happens to be more persistent than we currently expect, default levels could lift from their historic lows and become a headwind for high yield as debt servicing costs rise.

Private Capital

Today’s current regulatory and interest rate environment has contributed to more private capital solutions. Companies of all sizes are choosing to stay private longer since they now have access to capital solutions without opening their company up to the publicly traded markets. In fact, over 98% of the 200,000 U.S. middle market businesses are private. This has resulted in more investment opportunities for qualified and accredited investors as the need for capital in the private markets has grown. Investors with long investment horizons and low liquidity needs can capitalize on these market dynamics by incorporating these illiquid investments into a portion of their portfolio.

Portfolio Consideration

This year has been characterized by high inflation, rising rates, and a destabilizing war, which has added much complexity to the market during a time when supply chains and international partnerships were already on shaky ground. Investments have moved towards cheaper valuations, but volatility will remain elevated as a new regime of deglobalization and monetary policy is ushered in.

In equities, a shift towards larger companies with strong balance sheets and free cash flow seems prudent to balance the risks of higher rates and inflation. Internationally, a very strong U.S. Dollar has only added to the benefits of investing in companies in developed countries overseas. Emerging markets, while full of opportunity, has elevated levels of geopolitical risks that may lead to outsized volatility. We expect to see a shift toward more developed countries in the overall composition of international portfolios.

Bonds have seen a resurgence in yield while maintaining healthy credit spreads. As mentioned previously, bonds are now adding meaningful income in addition to diversification and risk management inside of portfolios. Higher yielding credit has also experienced increasing returns, but with a recession looming, choosing quality credit seems appropriate. Opportunistic credit continues to play a valuable role in portfolios as fast-moving rate policy will lead to chances to put money to work when the market gets volatile. Portfolios may see a small increase in risk in 2023 as stocks and bonds are more likely to move in unison for a short period of time as the economy works through these inflationary times.

These considerations are part of a long-term investment strategy focused on diversified portfolios designed to match investment goals and personal risk tolerance. Like any year, 2023 will undoubtedly provide some unexpected outcomes not mentioned in this outlook. During these uncertain times, our dedicated financial professionals are here to work alongside you to help meet your goals.

The INTRUST 2023 Economic Outlook is the consensus of the INTRUST Bank, N.A. (“INTRUST”) Investment Strategy team and is based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The forward-looking perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

01/10/2023

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)